The Tax Havens at the Heart of the Manafort Indictment

If Paul Manafort had not been such a crummy and absentee Brooklyn neighbor, he might not be in such hot water. He would not have crossed an urbane housewife-turned-blogger who doesn't consider herself a journalist but smelled something fishy around an unsightly townhouse. There's no more improbable anecdote to Manafort's indictment for laundering millions of dollars than the saga of Katia Kelly, a German-born former aspiring fashion designer who stumbled upon the curious purchase history of a Brooklyn brownstone that's now evidence in the money laundering case against Manafort. If ever there was a tale of all politics being local — and ramifications occasionally being national — this is it."I am not really a reporter," Kelly told me Tuesday as she helped her father close up his North Carolina beach house. She grew up in Germany and France and moved with the family at age 14 to Long Island, which she hated ("so dreadfully dull").

Meet the blogger who helped indict Paul Manafort

What does Paul Manafort's indictment mean for US tax reform?

Today’s Not a Good Day to Be George Papadopoulos on Twitter Wired

Here’s why Ukraine paid Manafort insane amounts of money VICE

In our defence we didn’t think you were thick enough for this to work, says Russia Daily Mash

Russian Influence Reached 126 Million Through Facebook Alone

Annie Leibovitz Reflects on the Obama Years

The 2016 election spoiled her plans for a tidy ending, but in her new book,

Leibovitz still finds meaning in a momentous and complicated decade...

The 2016 election spoiled her plans for a tidy ending, but in her new book,

Leibovitz still finds meaning in a momentous and complicated decade...

Mueller’s Collusion Case Comes into Focus

A former Trump campaign adviser has pleaded guilty to lying to the F.B.I. And he’s cooperating

Just How Screwed Is Trump in Papadopoulos-gate?

Wherever this investigation goes—either into a fever that suddenly breaks or

into genuine prosecutions of White House officials—one of the most

troubling questions is over whether Trump will allow Mueller to do his

work

On May 17, 2017, Robert S. Mueller III was appointed by acting Attorney General Rod J. Rosenstein to serve as Special Counsel by the order below. Order 3915-2017

On May 17, 2017, Robert S. Mueller III was appointed by acting Attorney General Rod J. Rosenstein to serve as Special Counsel by the order below. Order 3915-2017

- Politico Magazine – ‘The Russians Have Succeeded Beyond Their Wildest Expectations’- “Former intelligence chief James Clappersays President Trump is dead wrong about Russian interference in America’s elections. And they’re going to get away with it again, he warns. …”Clapper responded. “I mean, the Russians succeeded, I believe, beyond their wildest expectations. Their first objective in the election was to sow discontent, discord and disruption in our political life, and they have succeeded to a fare-thee-well. They have accelerated, amplified the polarization and the divisiveness in this country and they’ve undermined our democratic system. They wanted to create doubt in the minds of the public about our government and about our system, and they succeeded to a fare-thee-well.” “They’ve been emboldened,” he added, “and they will continue to do this.”

- Newsweek – Dirt on Hillary Clinton: Did Russian Operatives Use It to Lure George Papadopoulos, a Trump Campaign Adviser?

- The Atlantic – Robert Mueller Is Just Getting Started

- POGO – As Grand Jury Issues Indictment, Congress Should Continue Bipartisan Russian Investigations

- The New York Times – Investigations of Manafort in New York Are Beyond Trump’s Power to Pardon

- Wired – How to Interpret Robert Mueller’s Charges Against Paul Manafort

- CNN – The Russia Investigation

U.S. v. Paul J. Manafort, Jr., and Richard W. Gates III (1:17-cr-201, District of Columbia)

Paul J. Manafort, Jr., of Alexandria, Va., and Richard W. Gates III, of Richmond, Va., have been indicted by a federal grand jury on Oct. 27, 2017, in the District of Columbia. The indictment contains 12 counts: conspiracy against the United States, conspiracy to launder money, unregistered agent of a foreign principal, false and misleading FARA statements, false statements, and seven counts of failure to file reports of foreign bank and financial accounts. The case was unsealed on Oct. 30, 2017, after the defendants were permitted to surrender themselves to the custody of the FBI.

U.S. v. George Papadopoulos (1:17-cr-182, District of Columbia)

George Papadopoulos, of Chicago, Illinois, pleaded guilty on Oct. 5, 2017, to making false statements to FBI agents, in violation of 18 U.S.C. 1001. The case was unsealed on Oct. 30, 2017.

“Papadopoulos has to stay within US, surrendered passport and is prohibited from contacting certain US individuals, per court papers. $10 million bond, house arrest, ankle bracelet.”

Netflix Is Ending House of Cards, “Deeply Troubled” by Kevin Spacey Allegations

Where Music Meets Politics for Jason Isbell and St. Paul & the Broken Bones

Two

Alabama natives, singer-songwriter Isbell and St. Paul & the Broken

Bones frontman Paul Janeway, talk about the sound and soul of the

South.

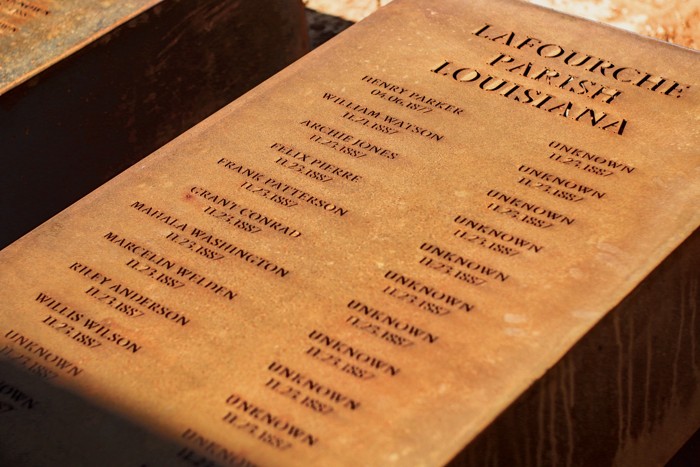

Hanged, Burned, Shot, Drowned, Beaten

In a region where symbols of the Confederacy are ubiquitous, an unprecedented memorial takes shape.